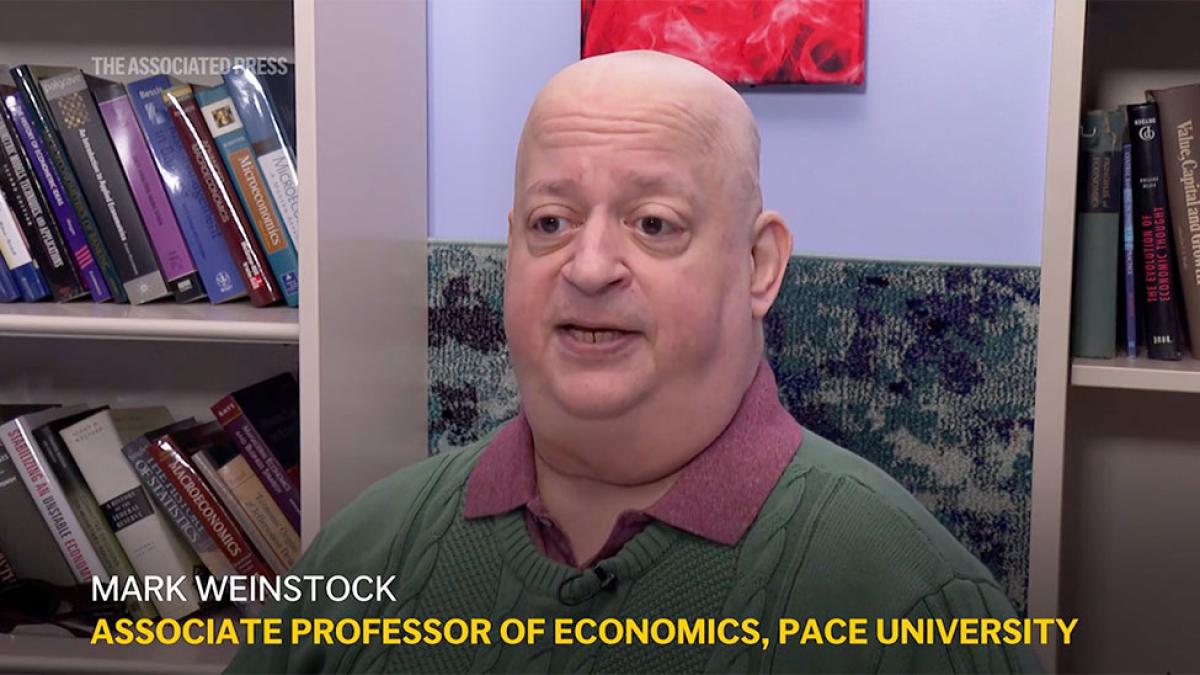

In the New York Post, Economics Professor Mark Weinstock unpacks the market chaos following President Trump’s tariff reversal, pointing to economic uncertainty as the real driver of volatility.

Mark Weinstock

MS Program Director

Biography

Faculty Bio

Mark Weinstock completed his undergraduate and graduate studies in Economics at The City University of New York. His contribution to non-linear econometric modeling of bank regulation received the Leon Horniker Award for Research Excellence. It was also at Hunter College and City College that he began to develop an eclectic teaching style which combined experimental classroom technologies and projects with video, real world examples, and humor, along with more traditional methodologies.

Weinstock was an electronics entrepreneur for many years, allowing him to bring real world elements of finance and business into the classroom to create a bridge between the theoretical underpinnings of economics and real-world applications.

He began his career at Pace University in 2000 where he was instrumental in developing a fresh and exciting approach to teaching economics. The new curriculum and pedagogy, he helped implement has helped lead hundreds of students to exciting and rewarding careers and graduate degrees at top graduate programs throughout the world. He has brought dozens of Pace students each year to external research conferences including the prestigious Economics Scholars Program at the Dallas Federal Reserve Bank by serving as their research advisor. He is a member of the Society of Fellows at Pace University with a class inducted under his name in 2015.

Courses Taught

Past Courses

ECO 105: Principles of Economics: Macro

ECO 106: Microeconomics - LC

ECO 106: Principles of Economics: Micro

ECO 106: Prncpl of Eco: Microeco - LC

ECO 106: Prncpls of Ecnmcs: Mcroecnmcs

ECO 211: Sports Economics

ECO 230: Intermediate Macroeconomics

ECO 234: Intermediate Microeconomics

ECO 238: Money and Banking

ECO 240: Quant Analysis & Forecasting

ECO 240: Quantitative Anlys & Forcastng

ECO 296: Mathematical Economics II

ECO 296: Topic: Sports & Entrtnmnt Eco

ECO 296: Tpc: Eco Crime, War/Terrorism

ECO 296: U.S. Eco & Monetary Policy

ECO 305: Glbl Finance & Ecnmc Actvty

ECO 328: Central Banking

ECO 357: Managerial Economics

ECO 360: International Economics

ECO 365: U.S Economic & Monetary pol.

ECO 365: US Economy & Public Policy

ECO 375: China's Financial System:

ECO 376: From Wall St to the Great Wall

ECO 380: Mathematical Economics

ECO 381: Applied Game Theory

ECO 382: Applied Game Theory II

ECO 390: Internship In Economics

ECO 395: Independent Study in Economics

ECO 396: Applied Game Theory II

ECO 396: Mathematical Economics III

ECO 396: Topic: Central Banking

ECO 396: Topic: Faces of the Fed

ECO 399: Public Economic Policy

ECO 400: Seminar in Economic Theory

ECO 530: Macroeconomic Analysis

ECO 638: Monetary Policy Analysis

ECO 657: Applied Managerial Economics

ECO 680: Applied Game Theory

ECO 699: Mstr Thss or 3 Pblc Plcy Essys

ECOA 106: Microeconomics

HON 499: Snr Smnr in Rsrch Mthds

LAS 201: Latin America,Caribbean & Wrld

LAS 260: South American Colossus:

MBA 808: Creating Value Thru Finance

UNV 101: First-Year Smnr Unvrsty Cmmnty

UNV 101: First-Yr Smnr: Unvrsty Commnty

Related News and Stories

Economics Professor Mark Weinstock discusses the impact of tariffs on global markets and the broader economic implications with PIX11.

Economics Professor Mark Weinstock appears on News 12’s Power & Politics to break down recent tariff impacts and market turbulence.