Webinar: Tax, Race, and Reparations: Reckoning with History, Rethinking the Future

An American Tax Policy Institute Webinar

Co-sponsored by the Taxation Program at the Elisabeth Haub School of Law at Pace Univeristy

Join the American Tax Policy Institute for a timely conversation with three leading scholars whose groundbreaking books challenge the ways tax law has reflected and reinforced racial injustice—historically, domestically, and globally. From colonial America's use of taxation to entrench slavery, to the racialized architecture of the international tax system, to a bold new legal strategy for achieving reparations in the United States, this book-centered discussion will explore how law and policy have long been tools of inequality and how they might be reclaimed for justice.

Each author will present key insights from their recent or forthcoming work, followed by a moderated discussion and audience Q&A. This interdisciplinary dialogue will be of interest to scholars, policymakers, students, and anyone engaged in conversations about racial equity, structural reform, and the future of tax justice.

Friday, March 6, 2025 | 12:00 p.m. Eastern

Zoom Webinar – Free With Pre-Registration Below

Moderator

- Bridget J. Crawford, American Tax Policy Institute President and University Distinguished Professor, Pace University

Featured Authors

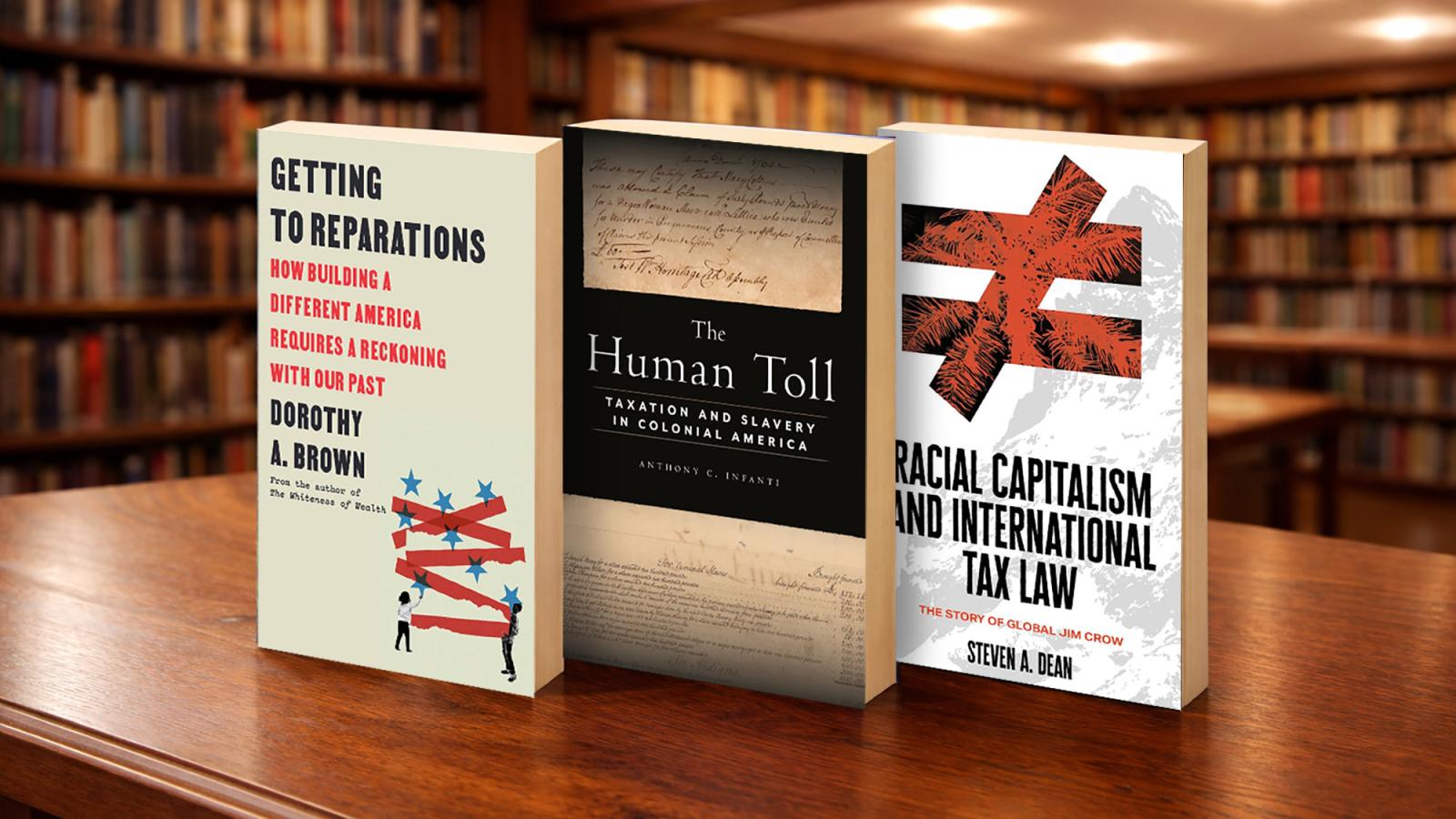

- Dorothy A. Brown, Getting to Reparations: How Building A Different America Requires a Reckoning with Our Past (Crown, 2026)

- Steven A. Dean, Racial Capitalism and International Tax Law: The Story of Global Jim Crow (Oxford University Press, 2025)

- Anthony C. Infanti, The Human Toll: Taxation and Slavery in Colonial America (NYU Press, 2025)

Location: Zoom (Free and open to the public with pre-registration)

Pre-registration is required.

For questions about the event, please contact Bridget Crawford at bcrawford@law.pace.edu.

Zoom Webinar

An American Tax Policy Institute Webinar

Co-sponsored by the Taxation Program at the Elisabeth Haub School of Law at Pace Univeristy

Join the American Tax Policy Institute for a timely conversation with three leading scholars whose groundbreaking books challenge the ways tax law has reflected and reinforced racial injustice—historically, domestically, and globally. From colonial America's use of taxation to entrench slavery, to the racialized architecture of the international tax system, to a bold new legal strategy for achieving reparations in the United States, this book-centered discussion will explore how law and policy have long been tools of inequality and how they might be reclaimed for justice.

Each author will present key insights from their recent or forthcoming work, followed by a moderated discussion and audience Q&A. This interdisciplinary dialogue will be of interest to scholars, policymakers, students, and anyone engaged in conversations about racial equity, structural reform, and the future of tax justice.

Friday, March 6, 2025 | 12:00 p.m. Eastern

Zoom Webinar – Free With Pre-Registration Below

Moderator

- Bridget J. Crawford, American Tax Policy Institute President and University Distinguished Professor, Pace University

Featured Authors

- Dorothy A. Brown, Getting to Reparations: How Building A Different America Requires a Reckoning with Our Past (Crown, 2026)

- Steven A. Dean, Racial Capitalism and International Tax Law: The Story of Global Jim Crow (Oxford University Press, 2025)

- Anthony C. Infanti, The Human Toll: Taxation and Slavery in Colonial America (NYU Press, 2025)

Location: Zoom (Free and open to the public with pre-registration)

Pre-registration is required.

For questions about the event, please contact Bridget Crawford at bcrawford@law.pace.edu.

Description America/New_York public