Master’s in Accounting vs MBA: Which Degree is Right for You?

As an aspiring finance or accounting professional, you have a range of opportunities to explore—finance roles offer strong earning potential, industry versatility, and long-term growth. But which path is right for you? One of the most important decisions you’ll make is whether to pursue a master’s in accounting or an MBA.

Both degrees build financial expertise and open doors to impactful careers, but they serve different goals. A master’s in accounting provides specialized knowledge for roles in auditing, taxation, and financial reporting, while an MBA offers a broader foundation in business leadership and strategy. Depending on your program, either degree may help you meet requirements for the Certified Public Accountant (CPA) exam, which can lead to career advancement and increased earning potential.

Read on to explore the key differences between these degrees and determine which best aligns with your interests and goals.

What is a Master's in Accounting?

A master’s degree in accounting (MS in accounting, , MAcc, or Master’s of accountancy) is a graduate-level program designed for individuals looking to deepen their expertise in accounting and financial disciplines. This program prepares students for careers in public accounting, corporate finance, auditing, taxation, and financial management. It also helps meet the educational requirements for becoming a Certified Public Accountant (CPA) or earning other professional accounting certifications.

- Degree Overview and Requirements: Most Master of Science in Accounting programs require between 30 and 50 credit hours, depending on the institution. Admission requirements may include an undergraduate or graduate degree in business, GMAT or GRE scores, and/or prerequisite coursework in financial and managerial accounting, business law, and economics.

- Duration of Program: The time to complete an MS in Accounting varies based on enrollment status. Full-time students typically finish within 12 to 18 months, while part-time students may take two to three years to earn this degree.

- Skills/Concepts Taught: Students learn technical knowledge and practical skills essential for the profession, including:

- Financial statement analysis: Interpreting and assessing financial data to support decision-making.

- Corporate financial planning: Budgeting, forecasting, and making data-driven financial decisions.

- Risk assessment and internal controls: Identifying financial risks and ensuring compliance with financial regulations.

- Tax Preparation and compliance: Understanding corporate, personal, and international tax laws.

- Business communication: Writing reports, preparing financial presentations, and effectively communicating with stakeholders.

- Specializations: Some programs provide opportunities in to specialize in specific financial areas, including:

- Technology and data analytics: Skills in using big data and analytics, AI, and ERP in auditing, cost management, and forensic accounting for advancement in analytics, audit analytics, and data-driven decision-making positions.

- Taxation: Analytical, research, and strategic skills to advise individuals, businesses, and organizations on corporate, partnership, international, estate, gift, and state and local tax matters.

- Forensic accounting: Skills to investigate financial fraud, conduct litigation support, analyze financial records for legal disputes, and ensure regulatory compliance in corporate and criminal cases.

What is a Master of Business Administration (MBA)?

A master of business administration (MBA) is a graduate degree that builds leadership, strategic thinking, and business management skills. Designed to prepare students for executive and management roles, an MBA provides a comprehensive understanding of business operations, decision-making, and problem-solving across industries.

- Degree Overview and Requirements: Most MBA programs require between 30 and 60 credit hours, depending on the program structure and specialization. While MBA programs typically do not have specific coursework prerequisites, some may require applicants to have prior professional experience.

- Duration of Program: The time to complete an MBA varies based on enrollment status and program format. Full-time students typically earn their degree in one to two years, while part-time programs designed for working professionals may take two to four years.

- Skills/Concepts Taught: Students gain knowledge and skills needed to manage organizations effectively, make data-driven decisions, and drive business growth, including:

- Financial management: Consists of financial decision-making, corporate finance, and investment strategies.

- Marketing strategy: Focuses on market research, consumer behavior, and branding.

- Operations and supply chain management: Examines production processes, logistics, and efficiency improvements.

- Accounting for managers: Provides a foundational understanding of financial and managerial accounting.

- Business analytics and data-driven decision making: Introduces analytical tools for interpreting business data.

- Ethics and corporate social responsibility: Discusses ethical leadership, sustainability, and corporate governance.

- Specializations: There are many different types of MBA specializations, with some of the most popular including:

- Finance: Focuses on corporate finance, investment management, risk analysis, and financial decision-making for businesses and institutions.

- Marketing: Covers consumer behavior, branding, digital marketing strategies, and market research to drive business growth and competitive advantage.

- Entrepreneurship: Equips students with skills in venture creation, business innovation, startup financing, and strategic growth planning.

- Talent management: Covers the analysis, design, and evaluation of human resources systems and processes, and how they are integrated within business strategy.

Master's in Accounting vs. MBA

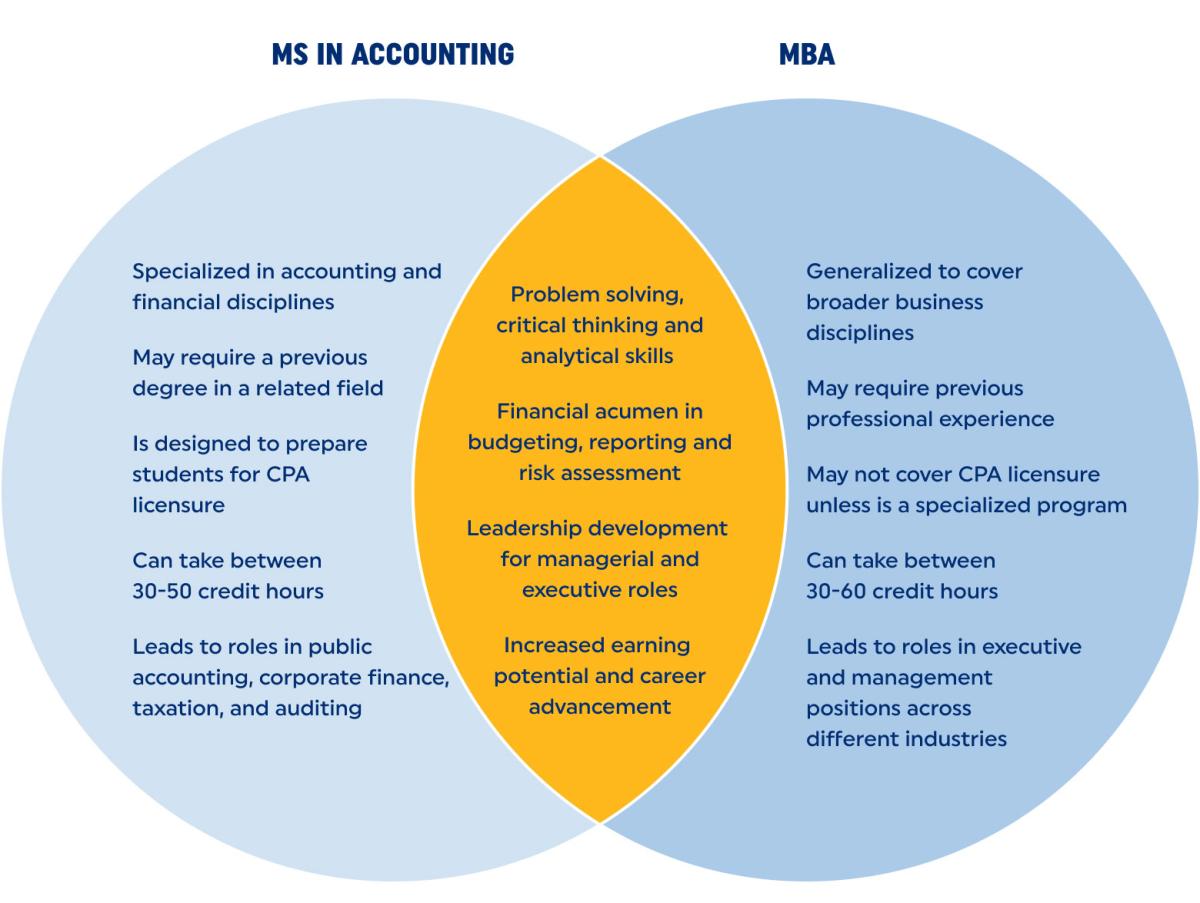

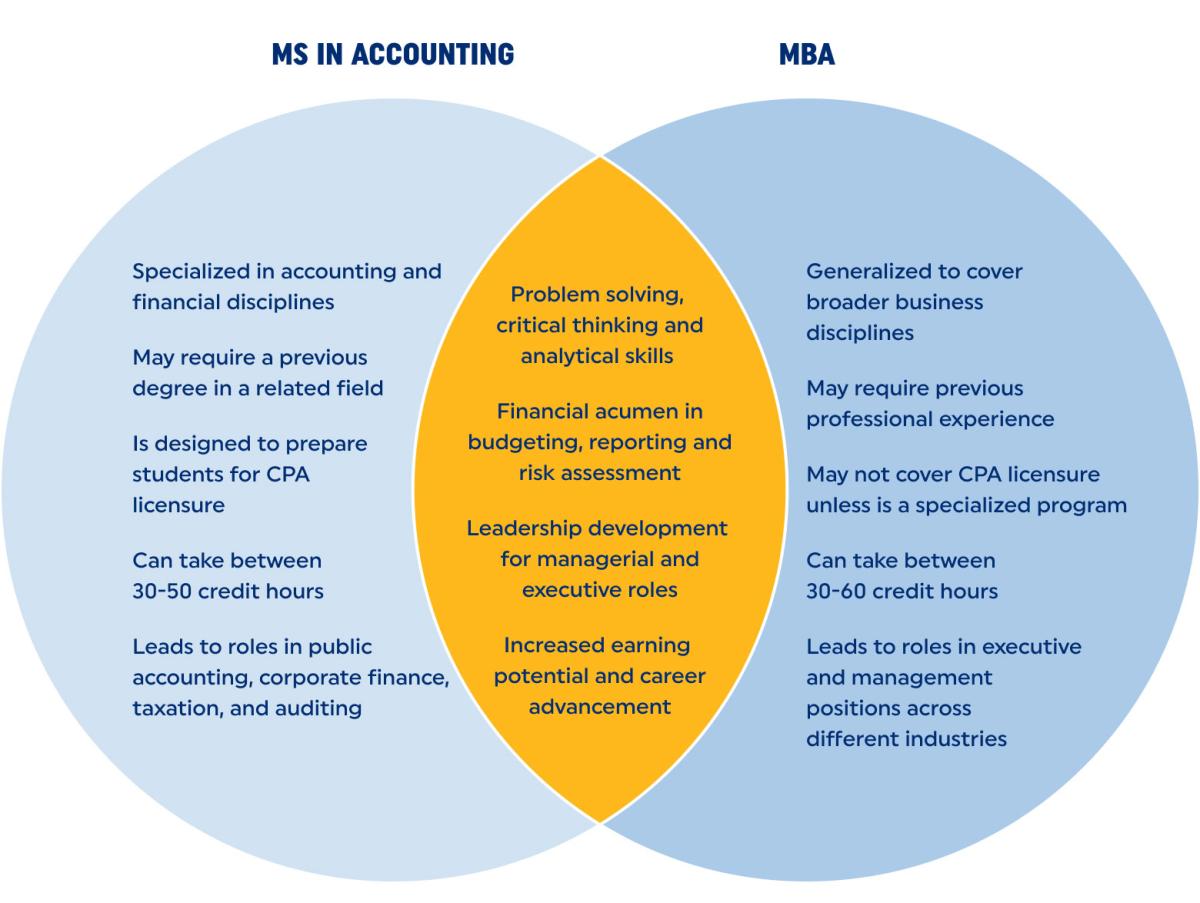

While both an MS in Accounting and an MBA provide advanced business education, they differ in focus, coursework, career pathways, and program structure.

- Coursework: The MS in Accounting offers specialized courses in financial regulations, compliance, and ethics, preparing students for careers in accounting and financial management. In contrast, an MBA provides a broader business education, covering finance, marketing, operations, strategy, and leadership.

- Prior Experience: MS in Accounting programs may require a related undergraduate degree but typically do not require prior professional experience. Most MBA programs, however, prefer applicants with professional experience and accept undergraduate degrees from a wide range of fields.

- Skills and Competencies: An MBA helps students develop broad business management skills, including strategic decision-making, leadership, and operations management. An MS in Accounting focuses on financial expertise, preparing students for careers in forensic accounting, tax preparation, auditing, financial reporting, and compliance.

- CPA Preparation: While an MBA with an accounting concentration may cover some accounting principles, it often does not fully meet CPA exam eligibility requirements. To prepare for the CPA exam, students should seek an MBA program specifically designed for CPA preparation, such as Pace’s Public Accounting MBA. Most MS in Accounting programs, including Pace’s Public Accounting MS, are structured to meet the 150-credit hour CPA licensure requirement in many states, including New York.

- Duration: The MS in Accounting may require fewer credit hours (30–50 credits) and can often be completed in 12–18 months (sometimes as quickly as one year). MBA programs generally require more credit hours (30–60), with full-time programs taking 18–24 months to complete.

- Career Goals: A master’s degree in accounting is meant to prepare students for a higher-level or management position in public accounting, corporate finance, taxation, forensic accounting, and auditing, while an MBA offers the same preparation for management and executive positions across industries, including finance, marketing, consulting, and entrepreneurship.

MBA vs Master of Professional Accounting Comparison

| Criteria | MBA | MS in Accounting |

|---|---|---|

| Prior Coursework | Non-business or generalist business degree | Degree in accounting or related financial field |

| Professional Background | A few years of professional experience are expected and often required by some programs | None required; may have limited professional experience |

| Duration | Requires 30-60 credit hours | Requires 30-50 credit hours |

| Skills Learned | Include forensic accounting, tax preparation, auditing, financial reporting, and compliance | Include decision-making, leadership, and operations management |

| Career Goals | To achieve a management or executive level position and the flexibility to work in a variety of fields | To be a CPA and pursue a career in public accounting, corporate finance, taxation, forensic accounting, or auditing |

Similarities Between a Master's in Accounting and an MBA

The MBA and master’s in accountancy do share some similarities in how they prepare students for professional careers.

- Analytical Skills: Both programs emphasize data analysis, critical thinking, and problem-solving to help students make informed business decisions. Courses in business analytics, data-driven decision-making, and financial modeling are common in both degrees.

- Financial Acumen: Both degrees cover financial reporting, budgeting, risk assessment, and performance measurement. Both programs teach students how to assess a company’s financial health and make data-driven financial decisions.

- Leadership Development: Both degrees prepare students for managerial and executive positions, whether in accounting firms, corporations, or entrepreneurial ventures. Leadership courses in both programs focus on ethical decision-making, team management, and strategic thinking.

- Career Advancement: Both degrees increase earning potential and open doors to higher-level job positions, including C-suite positions. MS in Accounting graduates often advance to CFO roles and MBA graduates move into CEO, COO, or VP positions.

Career Paths for Accounting Graduates

Master's in accounting graduates typically work in more structured settings such as accounting firms, corporate accounting departments, government bodies or financial institutions. Popular career paths include roles in specialized financial reporting, auditing, taxation, and compliance. Director and vice president positions are also possible with enough years of experience.

- Accountant: Prepares and maintains financial records, ensures compliance with tax laws and regulations, and manages financial reporting for businesses or individuals.

- Auditor: Examines financial statements and internal controls to ensure accuracy, comply with regulations, and identify potential risks or fraud.

- Forensic Accountant: Investigates financial fraud, analyzes financial records for legal disputes, and provides expert testimony in cases involving financial misconduct.

- Financial Analyst: Assesses financial data, market trends, and company performance to provide investment recommendations and strategic financial planning.

- Director of Accounting: Oversees accounting operations, ensures compliance with financial reporting standards, and manages teams responsible for budgeting, auditing, and tax preparation.

- VP of Finance: Leads an organization’s financial strategy, oversees budgeting, forecasting, and financial planning, and provides executive-level financial guidance to drive business growth.

| Job Title | Required Skills | Salary Range (USD)* New York Metro |

|---|---|---|

| Accountant |

| $80,000—$134,000 |

| Auditor |

| $81,000—$124,000 |

| Forensic Accountant |

| $96,000—$160,000 |

| Financial Analyst |

| $95,000—$151,000 |

| Director of Accounting |

| $170,000—$258,000 |

| VP of Finance |

| $235,000—$372,000 |

* Salary ranges are subject to change and will vary based on experience, location, and industry.

Values were sourced from Glassdoor in February, 2025.

Career Paths for MBA Graduates

Graduates of MBA programs often take on broad managerial roles, overseeing multiple departments, making strategic decisions, and driving business growth. Those with a financial specialization may pursue careers as financial managers or directors in corporate offices, startups, and nonprofit organizations. With experience, professionals can advance to senior leadership or C-suite positions such as chief financial officer (CFO) or chief operating officer (COO).

- Finance Manager: Oversees financial planning, budgeting, and analysis to support business decision-making, ensuring financial health and compliance with regulations.

- Finance Director: Leads financial strategy, risk management, and reporting while ensuring compliance with financial regulations and overseeing budgeting and financial operations to drive business growth.

- VP of Finance: Leads an organization’s financial strategy, oversees budgeting, forecasting, and financial planning, and provides executive-level financial guidance to drive business growth.

- Chief Financial Officer: Oversees all financial aspects of an organization, including strategy, risk management, investments, and reporting, ensuring long-term financial stability.

- Chief Operating Officer: Manages daily business operations, streamlines processes, and ensures organizational efficiency across departments.

- Chief Executive Officer (CEO): Leads the overall vision, strategy, and decision-making for the company, driving growth and long-term success.

| Job Title | Required Skills | Salary Range (USD)* New York Metro |

|---|---|---|

| Finance Manager |

| $158,000—$261,000 |

| Finance Director |

| $181,000—$284,000 |

| VP of Finance |

| $235,000—$372,000 |

| Chief Financial Officer |

| $259,000—$467,000 |

| Chief Operating Officer |

| $252,000—$470,000 |

| Chief Executive Officer |

| $335,000—$625,000 |

* Salary ranges are subject to change and will vary based on experience, location, and industry.

Values were sourced from Glassdoor in February, 2025.

How to Choose Between an MBA and a Master's in Accounting

Choosing between an MBA and a Master of Science in Accounting (MS in Accounting) depends on your career goals, interests, and educational background. Consider the following factors:

- Career Goals: Broad Leadership vs. Specialized Expertise

Do you aspire to lead organizations and oversee multiple business functions, or are you more interested in specialized accounting roles? An MBA prepares you for executive and general management positions, while an MS in Accounting focuses on financial systems, auditing, tax law, and compliance. - Interests: Business Strategy vs. Financial Mastery

If you enjoy strategic decision-making, business operations, and growth management, an MBA provides a well-rounded skill set across multiple disciplines. If you prefer working with financial reporting, regulations, and compliance, an MS in Accounting offers the specialized expertise needed. - Educational Background: Business vs. Accounting Foundations

If you have a business background and want to expand into leadership or diverse industries, an MBA complements your experience. If you have an accounting-focused degree and want to deepen your expertise while meeting CPA requirements, an MS in Accounting may be the next step. - Long-Term Ambitions: Executive Leadership vs. Technical Mastery

Are you aiming for executive roles such as CEO or entrepreneur, or do you plan to specialize in accounting, tax, or auditing and advance to a chief financial officer role? - Making Your Decision

No matter which path you’re considering, connect with professionals in your target field to learn how their degree impacted their careers. Speak with career counselors to assess which program aligns with your strengths and professional goals. Research schools to compare curriculum, CPA exam eligibility, networking opportunities, and career placement rates.

FAQ

Which is better, an MBA or a master's in accounting?

The better degree depends on your career goals. An MBA offers broad business leadership skills, ideal for management or executive roles. A master’s in accounting focuses on technical expertise, preparing students for careers as CPAs or financial analysts. If you want flexibility across industries, choose an MBA. If you’re more interested in a career in accounting or finance, the master’s in accounting would be a better fit.

Is a master's in accounting equivalent to a CPA?

No, a master’s in accounting is not the same as a CPA. The master’s degree provides advanced accounting knowledge, but the CPA is a professional certification that requires additional exams and experience. A master's program can help you meet CPA exam requirements, but earning the CPA requires passing all four exam sections and meeting state-specific licensing criteria. Pace University’s accounting programs provide CPA review courses to all accounting majors and both our Master of Science and MBA programs are ready for the new "Core + Disciplines" CPA exams.

Is an MBA or CPA more valuable?

The value of an MBA or CPA depends on your career goals. If you want flexibility across industries and aspire toward management or executive roles, an MBA is better. If you aim for an accounting-focused career in auditing, tax, or financial reporting, then a CPA will hold more value.

No matter your specific interests, if you’re looking to advance into financial leadership, Pace University offers multiple options to help you achieve your goals. Choose between an MBA in Public Accounting—which includes CPA preparation—or an MS in Public Accounting, designed to meet CPA licensure requirements. The MS in Public Accounting is available online as well as at our Westchester and New York City campuses.

For those interested in a broader business education beyond finance, Pace also offers a General Business MBA. Contact us to learn more about our programs and find the right fit for your career goals.

More from Pace

As the demand for skilled accountants surges and the talent pipeline shrinks, Pace University is stepping up. With a legacy dating back to 1906, the Lubin School of Business is leading the charge—equipping accounting students with in-demand skills in AI, data, and ESG. In a changing profession, Pace continues to deliver the talent the industry needs now and next.

The Lubin School of Business has been selected as one of LinkedIn's Top 100 MBA Programs Worldwide to Grow Your Career. This international ranking recognizes our dedication to student outcomes and to empowering the next generation of business leaders in today's rapidly evolving workforce.

This guide highlights top business master’s degrees, each designed to provide the skills and knowledge that employers value most. Whether you’re a recent graduate or an experienced professional, these programs can open doors to influential roles and provide a pathway to long-term career growth.